Browse Foreign Markets: Currency Exchange in Toronto Simplified

Browse Foreign Markets: Currency Exchange in Toronto Simplified

Blog Article

Expert Tips on Navigating the Money Exchange Market Successfully

Navigating the currency exchange market can be an intricate endeavor, particularly for those seeking to maximize their returns while minimizing dangers. As we discover the ins and outs of this dynamic landscape, it ends up being evident that expert pointers hold the trick to unlocking possibilities that could or else continue to be concealed. From figuring out market fads to adjusting to vital elements influencing exchange prices, there are strategic maneuvers that experienced experts utilize to remain ahead of the curve. By delving right into the subtleties of creating a strong trading approach and leveraging innovative technology for extensive analysis, traders can get a competitive side in this busy setting. In addition, the significance of risk management and guarding investments can not be overstated in a world where volatility rules supreme.

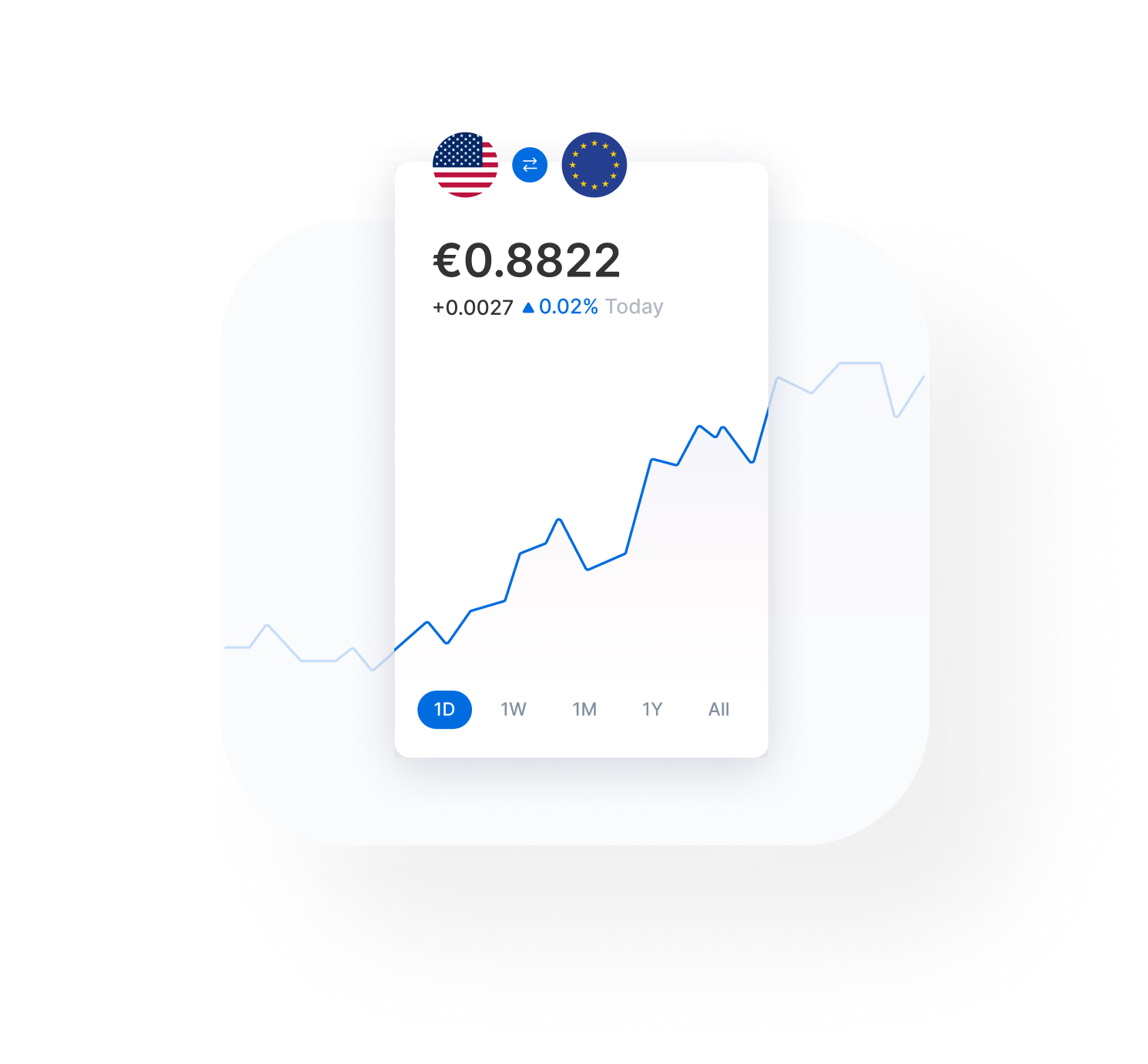

Comprehending Market Trends

To browse the money exchange market effectively, it is vital to have an eager understanding of market patterns. Market trends refer to the basic direction in which the market is conforming time. By analyzing these fads, traders can make even more informed choices about when to buy or sell money. One essential element of understanding market fads is recognizing whether a currency is depreciating or appreciating in value about others. This info can assist investors anticipate possible market activities and adjust their methods as necessary.

Monitoring financial indicators, political occasions, and worldwide information can offer valuable insights right into market patterns. For instance, a country's rates of interest, GDP development, inflation rates, and political security can all affect its currency's stamina on the market. By remaining educated regarding these aspects, investors can better interpret market trends and make calculated trading decisions.

Trick Variables Affecting Exchange Rates

An extensive understanding of the crucial elements affecting currency exchange rate is vital for navigating the intricacies of the currency exchange market properly. Currency exchange rate are affected by a multitude of aspects, with a few of the most substantial ones being interest rates, rising cost of living, political stability, financial efficiency, and supposition.

Rate of interest play a crucial duty in figuring out exchange rates. Countries with greater passion rates often tend to attract even more foreign resources due to higher rois, bring about an admiration of their money. Conversely, reduced rates of interest can lead to currency depreciation.

Inflation is another important factor influencing currency exchange rate. currency exchange in toronto. Countries with reduced inflation prices commonly see a recognition in their money value as their buying power boosts

Political stability and economic efficiency additionally influence exchange prices. Nations with steady governments and solid economic efficiency typically have stronger currencies as they are seen as safe houses for investments.

Speculation in the forex market can likewise lead to changes in exchange prices. Financiers and investors predicting future currency movements can cause abrupt modifications in exchange rates. When dealing with foreign exchange purchases., comprehending and analyzing these key factors can assist people and organizations make informed choices.

Creating a Strong Trading Approach

Comprehending the vital elements affecting currency exchange rate sets the structure for crafting a solid trading technique in the dynamic currency exchange market. When you have an understanding of just how different elements affect exchange price activities, you can start to develop a tactical technique to trading money successfully.

A solid trading technique generally entails establishing clear goals, establishing risk management procedures, and carrying out complete market analysis. Establishing certain earnings targets and stop-loss levels can assist you remain regimented and avoid psychological decision-making throughout professions. In addition, including technological analysis devices and staying educated concerning international financial occasions can offer beneficial insights for making notified trading choices.

Furthermore, diversity throughout various currency sets and timespan can aid spread out danger and enhance trading opportunities. It is vital to continuously assess and adjust your trading method based upon market problems and efficiency evaluation. By establishing a well-thought-out trading strategy that lines up with your threat resistance and economic goals, you can boost your possibilities of success in the currency exchange market.

Leveraging Modern Technology for Analysis

Including innovative technical tools can substantially improve the precision and efficiency of market evaluation in the currency exchange industry. Using advanced formulas and data analytics software application can offer investors with important insights right into market patterns, price motions, and possible chances. These tools can assist in conducting comprehensive technical evaluation, determining essential assistance and resistance degrees, and predicting future cost activities with greater accuracy.

Furthermore, leveraging modern technology for analysis permits investors to automate trading strategies based upon pre-programmed criteria, aiding in performing trades quickly and efficiently. By using trading platforms with advanced charting functions and real-time data feeds, investors can make informed choices quickly, maximizing their possibilities of success in the money exchange market.

:max_bytes(150000):strip_icc()/foreign-exchange-markets.asp-final-16abed069d5e4ba0924142476dec4211.png)

Taking Care Of Threat and Protecting Investments

To efficiently navigate the currency exchange market, prudent threat management approaches are necessary for securing investments and making sure lasting success. One basic way to take care of danger in the money exchange market is via diversity. By spreading financial investments across different money or property courses, financiers can minimize the influence of volatility in any kind of one market. Furthermore, establishing stop-loss orders can assist restrict prospective losses by immediately offering a money when it reaches an established price. It's also crucial to remain informed about geopolitical events, economic indications, and market patterns that can influence money worths. Using tools like routing quits, which adjust the stop-loss price as the currency moves in a favorable instructions, can aid shield profits while allowing for possible development. In addition, using appropriate position sizing methods, such as not taking the chance of even more than a specific portion of the total investment on a single profession, can assist prevent significant losses. By implementing these risk monitoring methods, financiers can mitigate potential drawbacks and important site secure their financial investments in the money exchange market.

Final Thought

In verdict, navigating the money exchange market successfully needs a deep understanding of market patterns, key elements affecting currency exchange rate, and the growth of a strong trading approach. Leveraging innovation for analysis and managing danger are critical for protecting investments. By remaining informed and carrying out reliable techniques, traders can increase their chances of success in the money exchange market.

By welcoming modern technology for evaluation, traders can stay ahead of the curve and make more informed trading decisions in the dynamic currency exchange market.

In verdict, navigating the currency exchange market successfully needs a deep understanding of market fads, key aspects affecting exchange prices, and the growth of a solid trading strategy.

Report this page